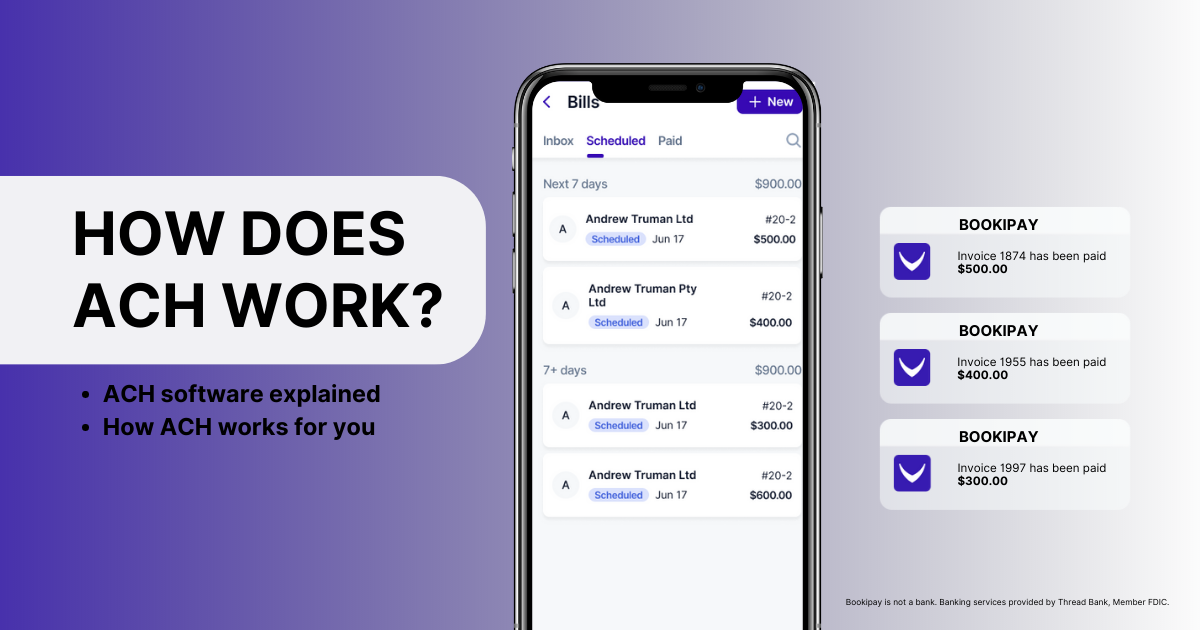

ACH software explained:

An automated clearing house (ACH) is a type of software used by businesses and financial institutions to electronically transfer funds between bank accounts.

ACH software enables organizations to initiate and receive payments directly to and from bank accounts, and to manage transactions in bulk.

It streamlines the process of electronic funds transfers, reduces processing time and costs, and minimizes errors associated with manual processes.

ACH transactions include direct deposit of payroll, electronic bill payments, business-to-business payments, and government payments such as tax refunds and social security benefits. ACH software is regulated by the National Automated Clearing House Association (NACHA) in the US.

ACH software typically integrates with accounting and ERP systems, allowing businesses to easily reconcile transactions and manage cash flow. It can also provide reporting and analytics on payment data, allowing organizations to gain insights into their financial operations and improve their cash management.

How ACH works for you

Initiation:

Individuals or organizations initiate a transaction by providing their bank account information, such as their routing number and account number, along with the amount they wish to transfer.

Authorization:

Once the account information is verified, the bank verifies that there are sufficient funds to cover the transaction. The bank sends the ACH network the details of the transaction once it has been authorized.Batch Processing:

ACH networks combine multiple transactions from different banks into batches for processing. Transacting in this way is more efficient and cost-effective.Clearing:

Through the ACH network, the batch of transactions is verified that the account information is accurate and that the funds are available.Settlement:

The funds are settled after the transactions are cleared between the banks involved. It usually takes between two to five business days to complete this process.Notification:

After the funds have been transferred successfully, the individual or organization initiating the transaction is notified.

ACH is a convenient and efficient way to transfer funds between bank accounts, and is widely used for payroll, bill payments, and direct deposits.