Manage your bills from

anytime.

anywhere.

Stay on top of bills as a freelancer or small business owner. Receive reminders and track all your bills in one place.

Never pay another late fee again! Get the Bookipay mobile app for instant bill tracking on iOS and Android for free.

Bookipay is a financial technology company and is not a bank. Banking services provided by Thread Bank; Member FDIC.

Never miss a bill.

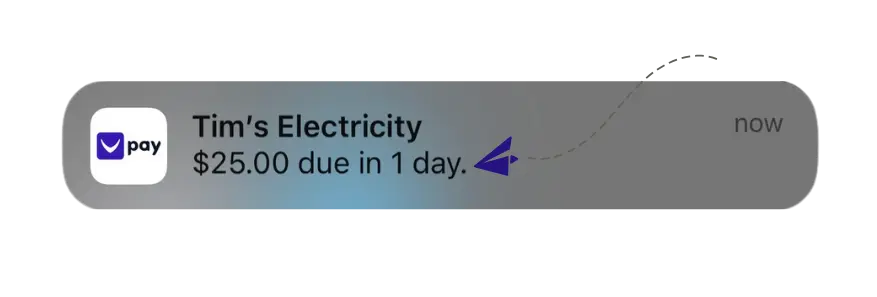

Bill Reminders

Bookipay can send you reminders when your bills are due, so you never miss a payment.

Track your Bills

Bookipay allows you to easily manage and pay your bills on time, avoiding late fees.

Safe and secure

Bookipay provides secure access to the app using your device's Passcode, Touch ID, or Face ID.

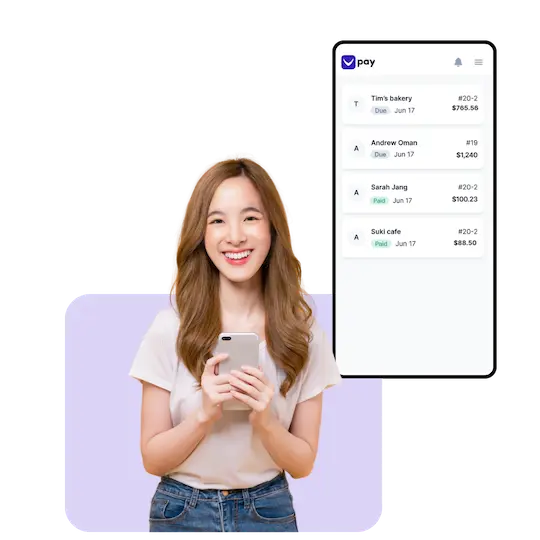

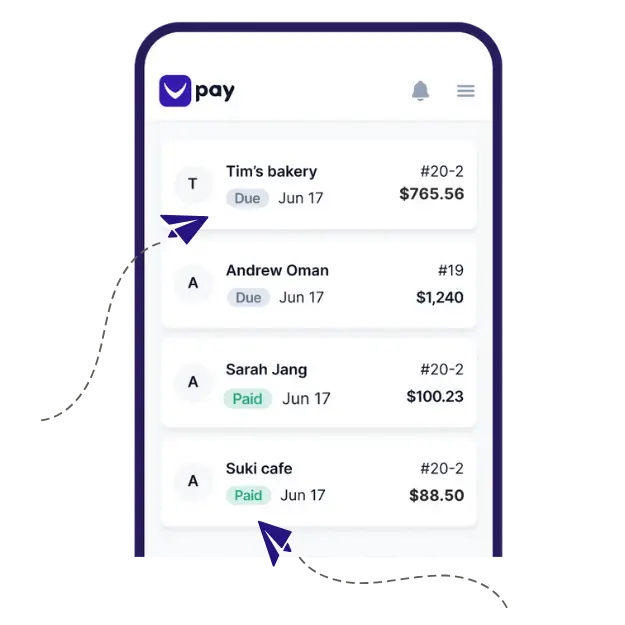

Manage your bills easily

Staying on top of your future expenses is simple when you can view bills, vendors, and suppliers in one place.

- Adding bills and vendors is as simple as tapping — one place to save and organize all your bills.

Keep track of your bills

Never forget a payment and improve your credit score with Bookipay’s bill reminder emails and push notifications.

- Easy-to-use bill manager and tracker for anyone to use.

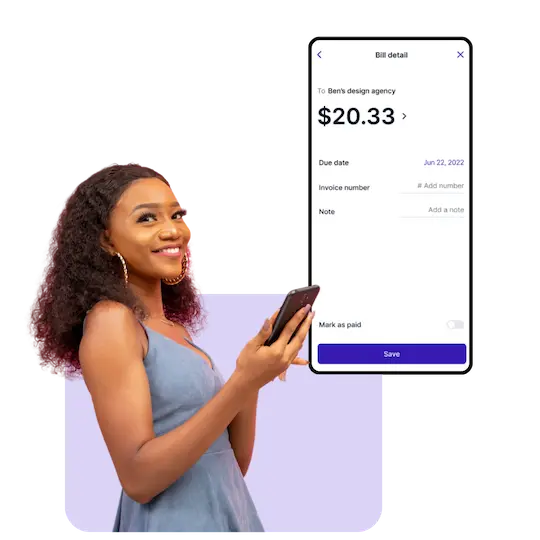

Manage bills on the go!

Bookipay makes bill management effortless by allowing you to access and manage your bills anywhere, anytime. You can easily track the status of your bills on the go.

- Easily track the status of your bills on the go — bills management is at your fingertips.

One place to manage all your bills

Save time and stay organized with the best bill management app.

- Create, save, and edit vendor and supplier details, mark bills as paid, and view outstanding bills from anywhere.

Pay bills on time

Bookipay helps small businesses manage accounts payable. Automate the process of tracking your business bills with our handy reminder system.

- Receive timely notifications via email and push messages so you remember to pay an important bill again.

Frequently Asked Questions (FAQs) about bill management

What is bill management?

Bill management is the process of organizing, tracking, and paying bills on time. Managing your financial obligations is essential for good financial health. By staying on top of bills, you avoid late fees or penalties and maintain credit scores.

Why is bill management important for individuals, freelancers, and small businesses?

Maintaining your financial health as a freelancer or small business is vital. Bills management is an important part of this.

Bill management helps you in the following ways:

- Avoid late fees and overdue penalties. Paying bills on time helps avoid unnecessary and costly late penalties.

- Maintain good credit scores. Good credit scores help individuals with their finances. Getting personal loans, credit cards, and interest rates is easier. Paying bills on time helps small businesses with credit checks. Businesses can better get business loans and relationships with suppliers and vendors.

- Managing cash flow to avoid cash crunches. Knowing when bills are due is important to keep your cash flow healthy. Make sure that there’s enough cash on hand to meet financial obligations.

- It helps you plan and budget your finances. You can better understand spending patterns and everyday expenses with good bill management. It’s easier to make more informed decisions about spending and planning your business’ future.

Can I use Bookipay bills management on mobile and web?

The free Bookipay bill manager app is currently available only on mobile app. This means you can track and manage bills easily from anywhere.

How often will I receive reminders for my bills with Bookipay?

Bookipay has a reminder schedule of 7 days, 3 days, 1 day, and overdue.

Is the Bookipay bill manager safe to use?

Bookipay provides secure access to the app using your device’s Passcode, Touch ID, or Face ID.