The ABA (American Bankers Association) number is a nine-digit code used by banks in the United States to identify the financial institution with which a bank account is connected.

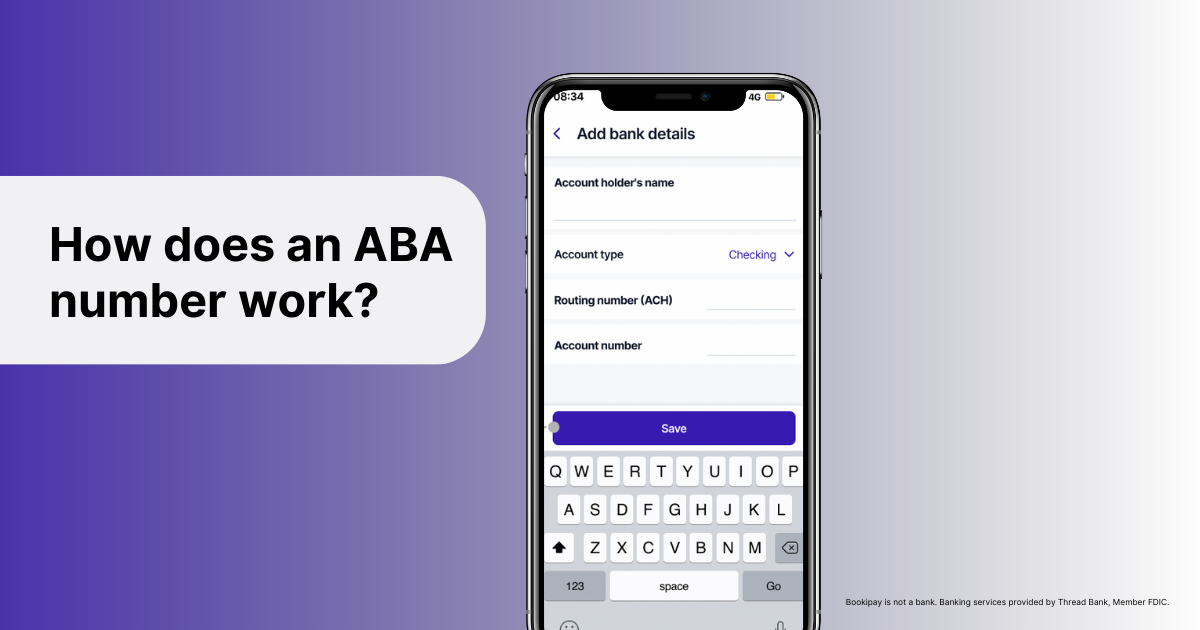

ABA numbers work by identifying the bank that is responsible for processing a transaction. When a transaction is initiated, the ABA number is used to route the funds to the correct bank for processing.

This can include transactions such as direct deposits, wire transfers, and electronic payments.

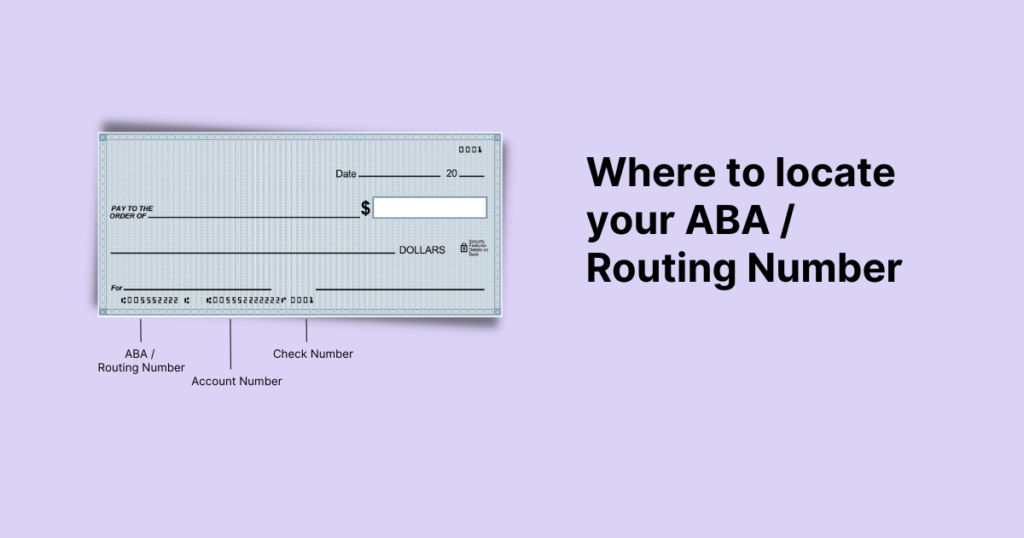

The ABA number consists of three parts: the first four digits identify the Federal Reserve Bank district that the bank is located in, the next four digits identify the specific bank, and the final digit is a check digit used for verification purposes.

When a transaction is initiated, the ABA number is included in the transaction information along with the account number and other details.

The receiving bank uses the ABA number to identify the correct financial institution and account for the funds to be deposited into.

ABA numbers are different from account numbers, which identify a specific account within a financial institution. There is a specific purpose for which ABA numbers are used. These are used to route transactions between banks.