Profit maximization is a key goal for any business owner, and managing bills efficiently is a vital part of achieving this goal. With the right strategy in place, you can optimize your spending and ensure that your expenses are aligned with your business goals. One useful tool for achieving this is the Bookipay app, which can help you streamline your bill management processes and simplify your financial operations.

To start, you should take a comprehensive inventory of your business bills and expenses, including recurring payments, utility bills, and other recurring expenses. This will help you get a clear picture of your financial situation and identify areas where you can potentially cut costs.

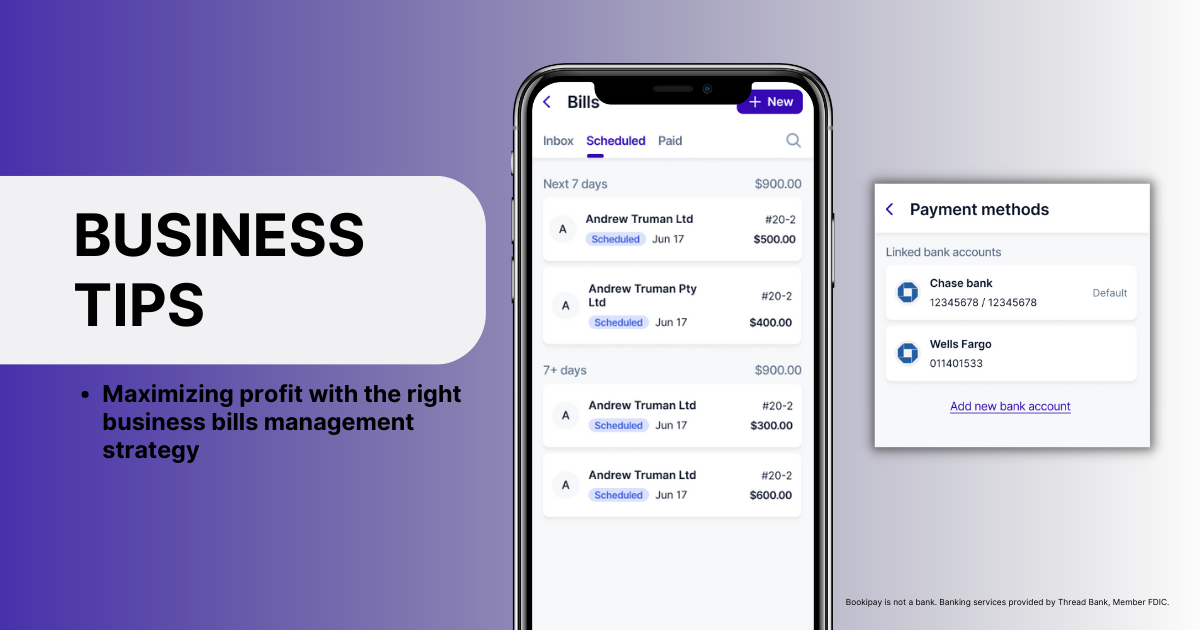

Next, you can use Bookipay to manage and automate your bill payments. The app allows you to set up automatic payments for recurring bills, which can save you time and ensure that you never miss a payment. You can also use the app to track your bills and expenses in real-time, which can help you stay on top of your finances and make informed decisions about your spending.

Another useful feature of Bookipay is its ability to analyze your bills and expenses and provide you with insights into your spending patterns. This can help you identify areas where you can potentially save money, such as by negotiating better rates with vendors or suppliers.

Ultimately, the key to maximizing profits through efficient bill management is to be proactive and stay on top of your finances. By using tools like Bookipay, you can simplify your bill management processes and focus on growing your business, rather than getting bogged down in administrative tasks.

With the Bookipay app, you can implement a smart bill management strategy that streamlines your finances and optimizes your spending to boost your profits.

Here are some steps you can take to maximize profit using Bookipay:

1. Categorize your bills

Start by categorizing your bills into essential and non-essential categories. This way, you can focus on the most critical bills that keep your business running smoothly and identify areas where you can cut back on unnecessary expenses.

2. Automate bill payments

Automating bill payments is a great way to ensure that you never miss a payment and avoid late fees. With Bookipay, you can set up automatic payments for your recurring bills, so you don’t have to worry about remembering to pay them manually.

3. Track your expenses in real-time

Use Bookipay to track your expenses in real-time, so you always know how much you’re spending and where your money is going. This will help you identify areas where you can reduce costs and optimize your spending to maximize your profits.

4. Analyze your spending patterns

Bookipay can provide you with detailed insights into your spending patterns, so you can see where your money is going and identify opportunities to reduce expenses. Use this information to negotiate better rates with suppliers or vendors, so you can save money and increase your profits.

5. Set financial goals

Finally, set financial goals for your business and use Bookipay to track your progress towards achieving them. This will help you stay focused on your objectives and ensure that your bill management strategy is aligned with your business goals.

By following these steps and using Bookipay to manage your bills and expenses, you can implement a smart bill management strategy that maximizes your profits and helps your business thrive.